SB 157: Growing Communities

The Community Bankers Association of Georgia (CBA) proudly announces a monumental achievement: SB 157 has enabled community banks in the state to secure over $1 billion in local municipal deposits, all fully insured by the FDIC through the approved networks IntraFi and Reich and Tang Deposit Solutions. This landmark legislation marks a turning point in leveling the playing field for community banks.

CBA President/CEO John McNair reflects on this journey, stating, "For years, community banks in Georgia were at a distinct disadvantage when competing against money center institutions for municipal deposits." McNair recounts the collaborative effort led by CBA's chief lobbyist, Lori Godfrey, and others, which culminated in SB 157 passing with unanimous bipartisan support. Illustrating the significance of the legislation, Gov. Kemp signed the bill into law at CBA headquarters in May 2019.

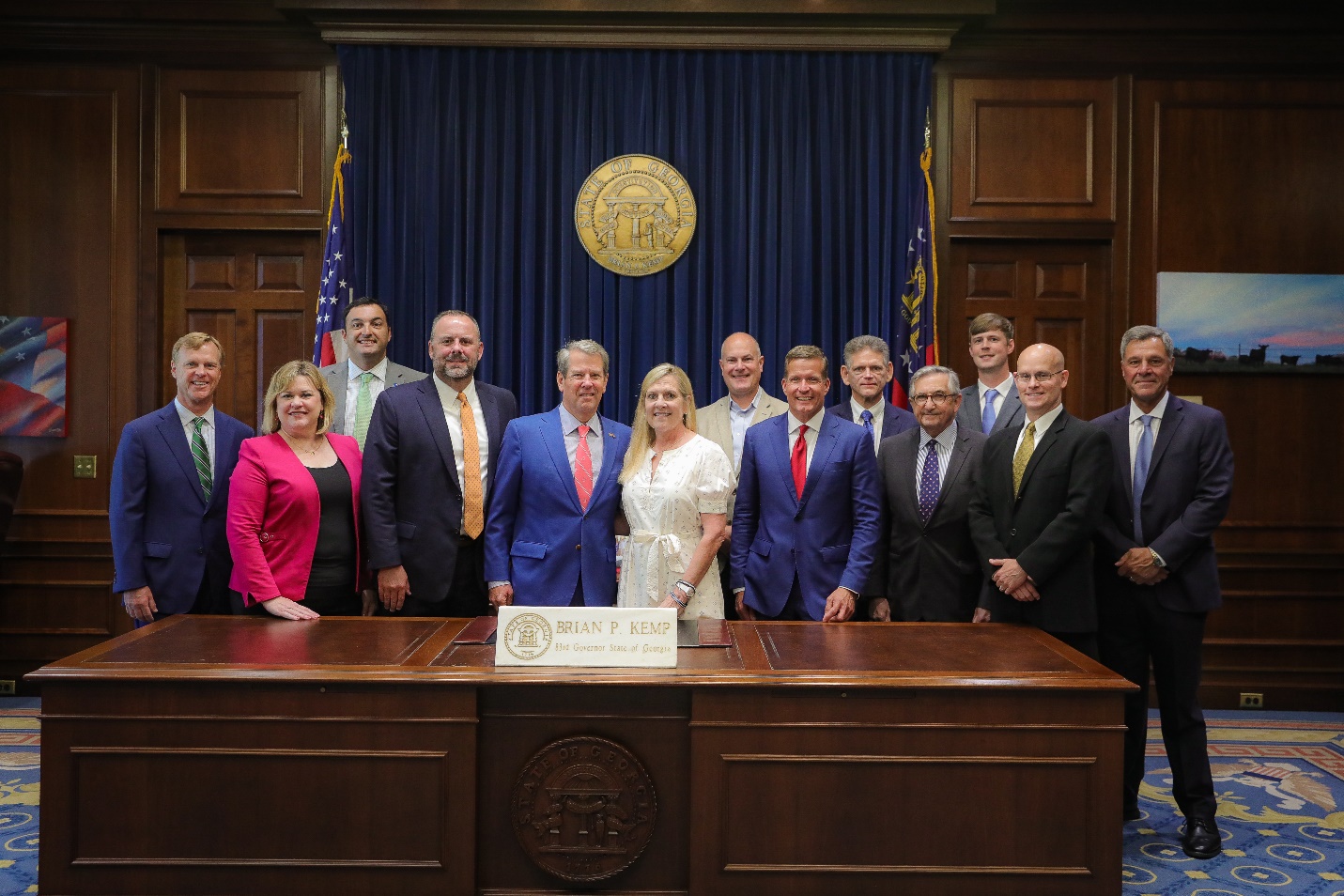

Recently, a delegation from CBA visited with Gov. Kemp to discuss the impact of the legislation and what more can be done to help Georgia’s community banks better serve their communities. “We appreciate the time Governor Kemp and The First Lady afforded us as well as the photo opportunity,” stated McNair.

Regarding the significance of the legislation, “when I signed SB 157, it was with the goal of leveling the playing field and ensuring Georgia’s small businesses have access to capital to grow and create good paying jobs,” said Governor Brian Kemp. “Our community banks know these businesses and local leaders better than anyone, and I’m proud of them for reaching this significant milestone and the positive impact it will have on the state’s long-term economic growth.”

Beyond the legislative triumph, the tangible impact of SB 157 is profound. At current loan-to-deposit ratios, the $1 billion in deposits translates into an estimated $700 million to $850 million in new loans generated by community banks. These loans fuel local economic growth, supporting small businesses, infrastructure projects, and affordable housing initiatives.

“SB 157 enabled our bank to make more loans by allowing us to compete for new municipal deposits which were used to fund new loan growth in our markets. We were able to obtain new deposits by offering higher interest rates on those deposits since loans provide a higher yield than bonds. The benefits were twofold: the municipalities increased interest income and our bank maintained good margin because of loans made to Georgia businesses and Georgia families,” stated Hunter Patton, The Peoples Bank of Georgia, Thomaston.

Neil Stevens, President/CEO of Oconee State Bank, Watkinsville noted “SB 157 was passed at a time when we were facing a liquidity crunch. We have a large amount of public funds. The passing of this bill was a tremendous relief to our bank and allowed us to free up liquidity to help other small businesses in the communities we serve.”

Moreover, by directing deposits to local community banks, municipalities keep taxpayer dollars within the community, leveraging the money multiplier effect. This not only fosters economic resilience but also strengthens the fabric of local communities.

Looking ahead, SB 157 sets a precedent for continued collaboration and advocacy in support of Georgia's community banks. As these institutions continue to thrive, they will play an increasingly vital role in driving economic prosperity at the grassroots level. Projections indicate sustained growth in lending activity, further solidifying the importance of SB 157 in fostering a vibrant community banking sector.

Join us in celebrating this momentous achievement and learn more about SB 157's impact on community banking in Georgia. Visit CBA of Georgia for additional resources and stay informed about future initiatives led by the Community Bankers Association of Georgia.