Advocacy Update 2025 - Legislative Days 6-9

Expansive Lawsuit Reform Package Unveiled

After inclement weather derailed many of last week’s budget hearings, the General Assembly quickly resumed business on Monday. This week saw a flurry of new legislation, and committees met in earnest to organize and begin moving measures forward.

On Thursday, Governor Brian Kemp unveiled his much-anticipated lawsuit reform package before a massive crowd gathered at the Capitol. His proposal calls for numerous policy reforms, including:

- Premises liability (the standard for negligent security liability)

- Phantom damages (truthful calculation of medical damages in personal injury cases)

- Seatbelt usage admissibility

- Third-party litigation funding

- Anchoring, bifurcated trials, double recovery of attorney’s fees, and other changes to civil procedure

While there are substantial political hurdles to overcome in the coming weeks, Governor Kemp, Lt. Governor Burt Jones, Speaker of the House Jon Burns, and Insurance Commissioner John King are committed to stabilizing Georgia’s insurance marketplace and ensuring transparency and fairness in the legal system through these bold reforms. Click here for an executive summary provided by the Governor’s Office.

CBA commends the reform package as these issues impact all citizens in Georgia including our bankers and their small business customers. As Gov. Kemp stated in his press conference, legislators do not want to hear from lobbyists on this issue. They need to hear from members of their communities. The hurdles cannot be overcome without each and every Georgian making their voice heard on these important issues. By using real life situations as examples in your discussions, legislators will be able to understand the direct impact to the voters within their communities.

Tax Incentive Evaluation: Bank Tax Credit

O.C.G.A. § 28-5-41.1 allows chairs of the House Ways and Means Committee and the Senate Finance Committee to each request up to five tax incentive evaluations annually. The incentives may be associated with income taxes, sales taxes, or premium taxes. The law requires the evaluations to include the incentive's net revenue, net cost, net economic activity, and net public benefit. Following passage of SB 366 during the 2024 session, future reports will include additional elements. One of the tax incentive evaluations performed related to the Bank Tax Credit. To review the parameters for consideration, click here.

The Department of Audits & Accounts published a summary of a report prepared by Georgia State University’s Fiscal Research Center (FRC) on December 3, 2024. Georgia’s bank tax credit offsets special occupation taxes levied on financial institutions by cites and counties. Local governments may impose a tax of up to 0.25 percent on gross receipts, as well as a minimum annual tax of no more than $1,000 a year. O.C.G.A. § 48-7-29.7 provides a credit against the banks’ state income tax liability that is equal to 100% of these local taxes. The credit is not refundable, but unused portions can be carried forward up to five years.

Georgia’s bank tax credit is intended to prevent double-taxing of financial institutions and ensure that banks are not taxed more heavily than other corporations. Double taxation would occur because Georgia banks are taxed at the state level through the corporate income tax and at the local level through the gross receipts tax.

FRC found that $47.6 million in FY20 has been claimed (newer years are still within the carryforward period). FRC estimated that $47.6 million within the industry would result in 178 total jobs and $50.3 million in value added to the state economy. However, FRC estimated that the same amount of economic activity (e.g. loans, interest income) would have occurred even in the absence of the exemption, at least during the short term covered in the review. As a result, there was not sufficient economic activity (e.g. jobs, labor income, value added, output) that could be tied specifically to the exemption. Due to the lack of any short-term economic activity attributable to the exemption, there is no economic or fiscal return on investment and the cost per job cannot be calculated.

The FRC noted that the bank tax credit provides several benefits to state residents. While the economic impact of the credit is not measurable in the short term, its absence could have an effect in the long term. Without such a credit, banks may be less likely to maintain the same number of local bank branches, limiting citizens’ access to bank branches in nearby areas.

The full report can be accessed here. CBA and Georgia Bankers Association signed a joint letter in July 2024 submitting a white paper for consideration on this topic.

New Legislation of Interest

Banking Related

Debanking Bill (SB 57) Sen. Blake Tillery, R—Vidalia

Assigned to the Senate Cmte on Jan-30

SB 57 prohibits discrimination in the provision of essential services, which is defined as financial services or utility services. Financial institutions means a bank or credit union that has more than $1 billion in assets and any affiliate or subsidiary of such bank or credit union.

Georgia Hemp Farming Act (SB 33) Sen. Kay Kirkpatrick, R—Marietta

Assigned to the Senate Regulated Industries and Utilities Cmte on Jan-28

SB 33 provides limits on the total THC concentration of consumable hemp products; it revises provisions concerning the certificate of analysis applicable to consumable hemp products.

Georgia Consumer Protection Towing Act (HB 184) Rep. Eddie Lumsden, R—Armuchee

Assigned to the House Motor Vehicles Cmte on Jan-30

HB 184 provides for consumer protections for emergency towing, owner requested towing, and private property towing.

Taxation

Tax Relief (HB 111 and HB 112) Reps. Soo Hong and Lauren McDonald

Assigned to the House Ways and Means Cmte on Jan-27

These measures provide tax relief to Georgia families and businesses and are part of Governor Kemp’s budget proposal for the year. HB 111 reduces the individual and corporate income tax rate to 5.19%. HB 112 provides a one-time tax credit for individual taxpayers who filed income tax returns in 2023 and 2024.

Sales Tax Exemption for Manufactured Homes (HB 134) Rep. Beth Camp, R—Concord

Assigned to the House Ways & Means Cmte on Jan-28

HB 134 revises and expands a sales tax exemption for manufactured homes. The first retail sale or retail purchase in this state of a new manufactured single-family structure shall be subject to the sales and use taxes which would otherwise be levied on such retail purchase or retail sale, but only upon 60 percent of the manufacturer’s invoice amount.

Judicial

First Offender Act Sentences (HB 162) Rep. Leesa Hagan, R—Vidalia

Assigned to the House Judiciary Non-Civil Cmte on Jan-29

HB 162 provides for the restriction and seal of First Offender Act sentences until such status is revoked.

Open Records Requests (SB 12) Sen. Frank Ginn, R—Danielsville

Assigned to the Senate Judiciary Cmte on Jan-16

SB 12 revises the state’s Open Records Request statutes relating to documents and records in the possession of private persons or entities and the judicial enforcement of such requests.

Notaries Public (HB 189) Rep. Marvin Lim, D—Norcross

Assigned to the House Judiciary Cmte on Jan-30

HB 189 provides for limitations regarding certain notarial acts.

Property

Property Owners’ Associations (HB 190) Rep. Marvin Lim, D—Norcross

Assigned to the House Judiciary Committee

HB 190 relates to specialized land transactions and prohibits condominium associations and property owners’ associations from retaliating against property owners for taking certain actions.

Technology

AI Accountability Act (SB 37) Sen. John Albers, R—Roswell

Assigned to the Senate Economic Development and Tourism Cmte on Jan-28

SB 37 requires all governmental entities to develop and maintain artificial intelligence system usage plans. It creates the Georgia Board for Artificial Intelligence to provide for guidance to governmental entities.

General Business

Red Tape Roll Back Act (SB 28) Sen. Greg Dolezal, R-Alpharetta

Assigned to the Senate Economic Development and Tourism Cmte on Jan-28

A priority of Lt. Governor Burt Jones, SB 28 provides for the preparation and submission of small business impact analyses for proposed legislation, rules, and regulations. It requires state agencies to complete a top-to-bottom review of their rules and regulations every four years. A similar measure (SB 429) fell just short of the finish line last year. For more information, click here.

Pawnbrokers (HB 110) Rep. Josh Bonner, R—Fayetteville

Assigned to the House Defense & Veterans Affairs Cmte on Jan-27

HB 110 prohibits pawnbrokers from making title pawns with covered borrowers, which is defined as active duty service members, active guard and reserve duty service members, and their dependents.

Senate Contact List for Lawsuit Reform

CBA of GA has compiled a list of targeted Senators regarding lawsuit reform. This includes GOP members who didn't sign both measures AND members of the Senate Judiciary Committee. We ask CBA of GA members to contact legislators if they reside in their district or are a business constituent.

Need Encouragement on Lawsuit Reform

Click here to locate a legislator by address. You can do this for your home and/or work address.

|

Senator Tim Bearden404-463-5257 tim.bearden@senate.ga.gov 404-474-7226 tim.bearden@rtastrategy.com Bremen, Carrollton, Douglasville, Mount Zion, Tallapoosa, Temple, Villa Rica |

Senator Bo Hatchett404-651-7745 bo.hatchett@senate.ga.gov 706-499-6941 bo@hatchettforgeorgia.com Baldwin, Clarkesville, Clayton, Commerce, Cornelia, Demorest, Franklin Springs, Homer, Lavonia, Maysville, Mount Airy, Royston, Toccoa, Young Harris |

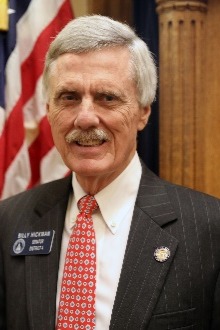

Senator Billy Hickman404-463-1371 billy.hickman@senate.ga.gov 912-682-5819 billyh@dhhccpa.com Brooklet, Claxton, Guyton, Metter, Pooler, Rincon, Springfield, Statesboro |

Senator Harold Jones404-656-0039 harold.jones@senate.ga.gov 706-339-1424 haroldjoneslawoffice@gmail.com Augusta-Richmond County, Hephzibah

|

|

Senator Elena Parent404-656-5109 elena.parent@senate.ga.gov 404-229-9596 elena@elenaparent.com Atlanta, Decatur, Lake City, Morrow |

|

Senator Doc Rhett404-656-0054 michael.rhett@senate.ga.gov 404-788-1683 hapevillees@hotmail.com Mableton, Marietta, Powder Springs |

|

Senator Brian Strickland404-656-0508 brian.strickland@senate.ga.gov 770-957-3937 bstrickland@smithwelchlaw.com Covington, Loganville, Madison, McDonough, Oxford, Porterdale, Social Circle, Walnut Grove |

|

Senator Carden Summers404-656-9224 carden.summer@senate.ga.gov 229-273-1300 cardenhs@gmail.com Ashburn, Broxton, Cordele, Douglas, Enigma, Fitzgerald, Lessburg, Nashville, Ocilla, Omega, Sylvester, Tifton |

Senator Blake Tillery404-656-5038 blake.tillery@senate.ga.gov 912-537-3030 blake@blaketillery.com Alma, Baxley, Douglas, Glennville, Hazlehurst, Jesup, Ludowici, Lyons, McRae, Mount Vernon, Nicholls, Reidsville, Vidalia |

Thank for Leadership on Lawsuit Reform

Senator John Kennedy404-656-6578 john.kennedy@senate.ga.gov Byron, Centerville, Forsyth, Fort Valley, Macon-Bibb County, Thomaston, Warner Robins |

|

Senator Bill Cowsert404-463-1366 bill.cowsert@senate.ga.gov Athens-Clarke County, Bogart, Dacula, Monroe, Watkinsville, Winder |

|

Senator Steve Gooch404-656-9221 steve.gooch@senate.ga.gov Blue Ridge, Cleveland, Dahlonega, Dawsonville, Ellijay, Jasper, McCaysville |